Top 20 Markets Ranked by Average Net Worth of 75+ Households

July 21, 2020

Having access to accurate data related to senior housing markets puts you in the best position to make informed investment decisions. Participants in the senior housing sector often place emphasis on net worth data as a senior’s net worth is typically one of many factors considered to indicate an ability to afford senior living services. As such, we have analyzed and ranked the MSAs (Metropolitan Statistical Areas) across the country with the highest average net worth among households where the head of the household is age 75 or older. This comprehensive net worth data can be accessed using the VisionLTC Market Insight service, along with 4,000+ data points related to senior housing demand.

Why Track Net Worth?

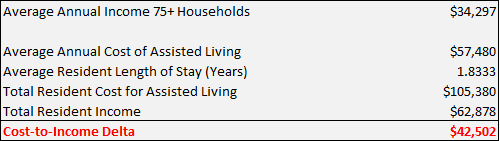

Given that there is a significant gap between the average cost of senior housing and the average income of 75+ households (see table below), we assume many seniors use a combination of income and other existing assets (part of their net worth) to pay for senior housing services. As such, it’s reasonable to conclude that senior households that have a higher net worth may have be better able to afford senior housing services. However, it’s important to note that higher net worth doesn’t always equate to higher demand for senior housing.

The table below shows the gap between the average cost of Assisted Living services and the average income of 75+ households.

Source: VisionLTC; NIC; and AssistedLiving.com

The average annual income nationwide for 75+ households is $34,297. The average annual cost for Assisted Living services nationwide is $57,480, and with the average resident length of stay in Assisted Living being 1.8 years, the assumed total cost of Assisted Living services over that time-period is $105,380. When you factor in the average income of 75+ households over that same time-period of 1.8 years ($62,878), you are left with a significant gap between the cost of Assisted Living and income (delta of $42,502). As such, many seniors tap into other assets that comprise their net worth outside of income to better afford senior living services and bridge the cost-to-income gap.

Analyzing Net Worth

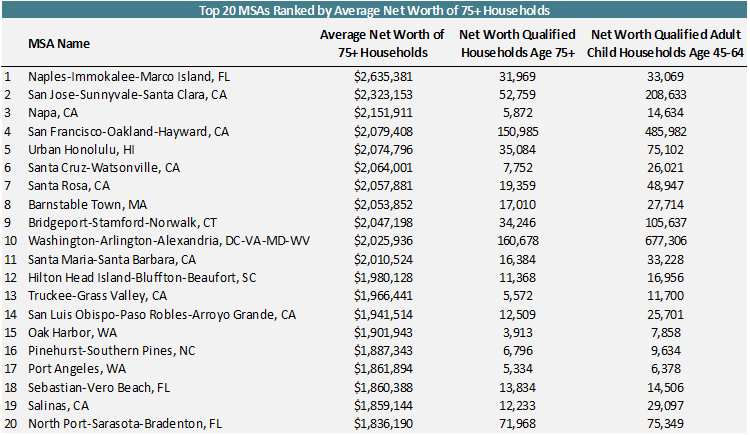

To gather the latest information, we ran an analysis to uncover the 20 MSAs across the country with the highest average net worth amongst 75+ households.

To be included in the analysis, the MSA must have a minimum of 5,000 households in which the head of the household is age 75 or older. Based on this criterion, 389 of the 929 MSAs that comprise the US qualified for the analysis.

The table below reports three stats:

• The average net worth of 75+ households in each MSA

• The # of net worth qualified 75+ households in each MSA

• The # of net worth qualified adult child households between ages 45-64 in each MSA

In this analysis, “net worth qualified” means that the household has a net worth of at least $105,380. This net worth threshold is equal to the assumed total cost of Assisted Living services over the average resident length of stay of 1.8 years. The # of net worth qualified adult child households where the head of the household is between the age of 45-64 are included in the analysis due to the fact that adult children sometimes help their parents pay for senior living services.

Here are the rankings:

*Net worth qualified = $105,380+ in total net worth

MSAs in California and Florida make up 60% of the top 20 list. 9 of the top 20 MSAs are in California and 3 of the top 20 MSAs are in Florida. The Naples-Immokalee-Marco Island, FL MSA has the highest average net worth in the country amongst 75+ households at $2,635,381.

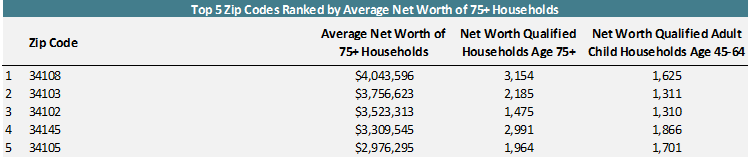

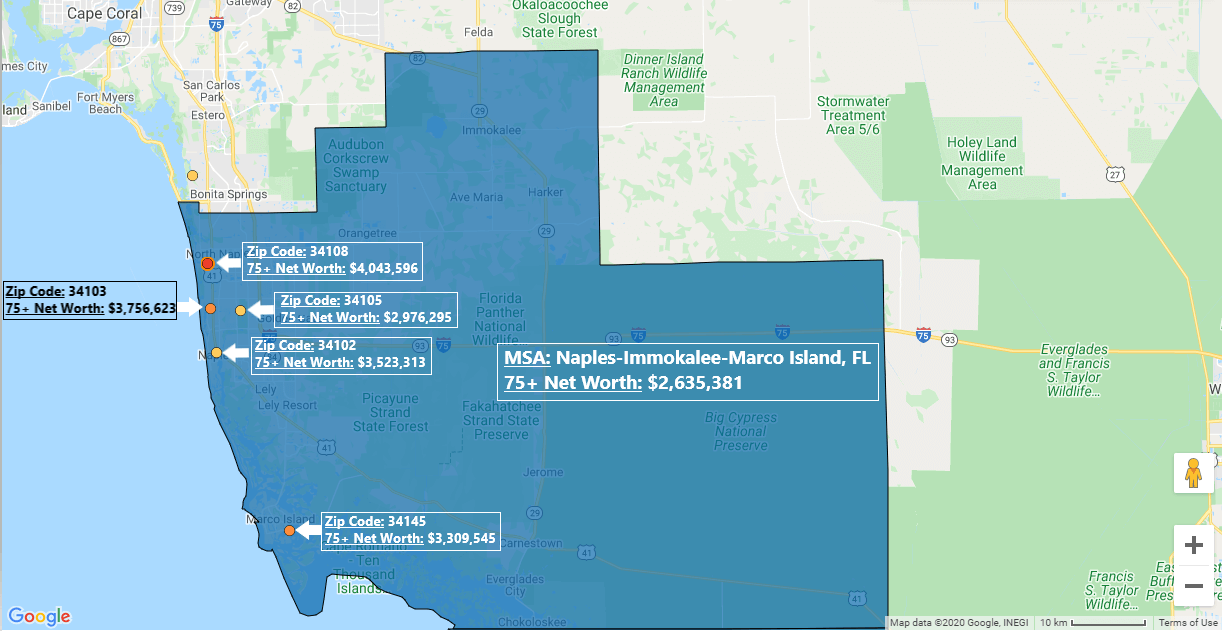

Top 5 Zip Codes

For a more granular understanding of where the various pockets of wealth exist within the Naples-Immokalee-Marco Island, FL MSA, we ranked the top 5 zip codes within the MSA by average net worth of 75+ households. Only zip codes containing 500 or more 75+ households were included in the analysis. Below are the rankings along with a map of where the zip codes are located within the MSA.

*Net worth qualified = $105,380+ in total net worth

Like what you see? There’s much more senior housing data to discover using VisionLTC’s comprehensive research and analytics platform, which provides data for markets nationwide. Our goal at VisionLTC is to help you unlock analytics in senior housing to gain unparalleled, real-time insight into local market dynamics nationwide. If you’d like to learn more about how VisionLTC tools can improve your market research capabilities, please request a short demo through our website by selecting “Schedule a Demo.”

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.