Skilled Nursing Occupancy Decline Accelerates in April

July 7, 2020

Today, NIC released monthly data from the NIC Skilled Nursing Data Initiative which incorporates key takeaways of market trends through April 2020. Going forward, NIC will continue to release updated data and insights on a monthly basis in response to rapid market changes caused by the COVID-19 pandemic and its impact on the skilled nursing industry. The following summarizes the monthly release with data from January 2012 through April 2020:

1. After the initial effects of the COVID-19 pandemic were evident in March, the skilled nursing occupancy rate eroded further and faster in April, ending the month at 78.9%. Since February 2020, when occupancy was still in the 84% range, occupancy has decreased 578 basis points. The acceleration in the occupancy decline is evident as it declined 137 basis points from February to March but declined 441 basis points from March to April. The impact of elective surgery suspension around the country in April along with many other state and local restrictions took a major toll on patient admissions. Historically, the month of April usually does see a decline in occupancy after the uptick in occupancy in the winter months due to higher admissions during flu season. However, any comparison to other years is problematic given the unprecedented impacts of the pandemic. Occupancy is now at its lowest level within the time-series going back to 2012. Year-over-year occupancy is down 554 basis points from April 2019 and down 458 basis points from the previous low set in June 2018 before the pandemic.

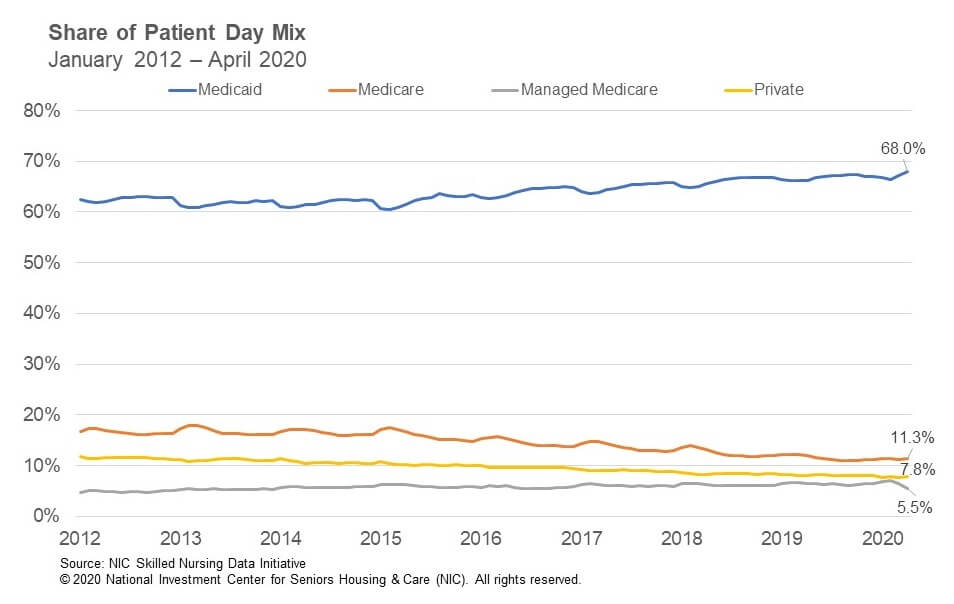

2. Managed Medicare patient day mix decreased 97 basis points from March to 5.5% in April as the impact of COVID likely put pressure on Medicare Advantage admissions. Throughout the country, elective surgeries were suspended due to the pandemic and resulted in many insurance plan enrollees forced to delay any hospital procedures that were not life threatening. This likely resulted in a decrease in hospital managed Medicare referrals to skilled nursing properties. Managed Medicare patient day mix is now down 146 basis points from February. The pressure on managed Medicare was also evident within revenue as its revenue mix declined from 9.8% percent in March to 7.8% in April. Year-over-year managed Medicare mix is down 196 basis points.

3. Medicare patient day mix increased, albeit slightly. It ended April at 11.3%, representing a 17-basis point increase from March and essentially flat compared to February. One potential reason for Medicare census holding relatively steady in the middle of the pandemic is the fact that the Centers for Medicare and Medicaid Services (CMS) waived the 3-Day Rule due to the crisis. This waives the requirement for a 3-day inpatient hospital stay prior to a Medicare-covered skilled nursing stay. This likely played a role in the steadiness of Medicare census at skilled nursing properties during the month of April. This is also evident in the Medicare revenue mix as it hovered around 20%.

4. Medicaid revenue per patient day (RPPD) increased significantly from March to April as many states increased reimbursement dollars to skilled nursing properties due to COVID-19. The monthly increase of $4.70 to $226.59 RPPD represented a 2.1% increase and was also the largest monthly increase since 2012 as many states increased reimbursement related to the number of COVD-19 cases at properties. Although this increase was significant, Medicaid still represents the lowest payer type in terms of RPPD when compared to private, Medicare, or managed Medicare. In addition, the concern continues to be that current Medicaid RPPD does not cover the actual cost of care in most states. Due to the measures taken by many states because of the pandemic, Medicaid RPPD increased by $10.53 compared to a year ago, representing a 4.9% increase.

NIC continues to grow its database of participating operators in the NIC Skilled Nursing Data Initiative in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form here. NIC maintains strict confidentiality of all data it receives.

About Bill Kauffman

Senior Principal Bill Kauffman works with the research team in providing research and analysis in various areas including sales transactions and skilled nursing. He has lead roles in creating new and enhanced products and implementation of new processes. Prior to joining NIC he worked at Shelter Development in investing/acquiring, financing, and asset management for over $1 billion in assets. He also had key roles in the value creation and strategic planning and analysis for over 65 entities. He received his Bachelor of Business Administration in Finance from the College of Business and Economics at Radford University and his Master of Science in Finance from Loyola College in Maryland. He also holds the Chartered Financial Analyst Designation (CFA).

NIC MAP Vision gives operators, lenders, investors, developers, and owners unparalleled market data for the seniors housing and care sector.